Article /

Bottom-Up Innovation for Adaptation Financing – New Approaches for Financing Adaptation Challenges Developed Through Practitioner Labs

Summary

This Innovation Brief presents six innovative bottom-up adaptation financing approaches from the SEED Practitioner Labs Climate Finance 2018 in India, Thailand and Uganda, and shares overarching learnings about challenges and solutions.

The Labs facilitated the development of the following prototype solutions with a focus on small- and medium-sized enterprises (SMEs):

- Mobile-Enabled Microinsurance (Uganda)

- Irrigation System Microleasing for High-Value Crops (Uganda)

- Green MSME Finance Tool (India)

- Last of Ours – Blockchain-based Conservation Fund (Thailand)

- Global Mangrove Trust – A Blockchain-based Conservation Finance Incentive (Thailand)

- Smart-Irrigation-as-a-Service Vehicle (Thailand)

For each prototype solution this brief provides a synopsis of the product prototype and details of its: Innovative Characteristics; Target Market; Impact Potential; Key Partners & Resources; Challenges in Implementation; and Market Analysis.

The Lab Approach

The Labs involved participants from a wide set of organisations such as microfinance institutions, commercial banks, development finance institutions, impact investors & philanthropic institutions, NGOs, corporate social investors, venture capital & angel investors, and government authorities.

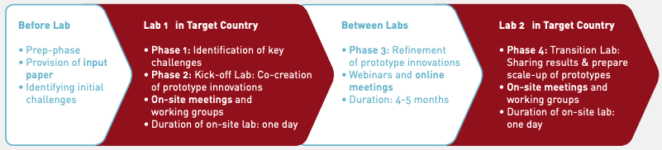

The Lab process consists of four major phases that build the basis for desirable wider long-term changes in the respective sectors or organisations. These phases are spread across two on-site Labs per country as well as webinars and online meetings between the two Lab events.

Find more information on the Labs here and from page 63 of the brief.

Challenges for Developing Bottom-Up Adaptation Financing Approaches

- Lack of capacities and information among enterprises on the ground, particularly the lack of financial literacy of SMEs is a crucial barrier for mobilising adaptation finance effectively.

- Financial institutions and investors often lack information on and technical understanding of innovative green technologies or adaptation measures and their impact to properly assess the creditworthiness of projects and understand the full business value of innovations in this space.

- Low accessibility of financial instruments for climate adaptation in remote areas as distribution networks and branches of financial institutions are often primarily located around (peri-)urban areas.

- Mismatch of demand and supply in the design of financial instruments: Particularly in the agricultural sector, there is misalignment between repayment schedules of loans or premium payments for insurances and seasonal income patterns of SMEs, particularly agribusinesses.

- Limited number of dedicated investors or donors involved in adaptation finance, with SMEs competing for very limited resources. This exemplifies the need for diversifying the sources of adaptation finance, mobilising new players, and developing self-sustaining business models.

Solutions for Addressing Recurring Challenges

- Strengthening of capacities on the ground through grouping enterprises, farmers or projects into networks and collectives in order to create synergies, peer learning opportunities, shared resources, and stronger collective bargaining positions.

- Provision of smart data gathering and sharing techniques with very different levels of complexity, ranging from blockchain-based impact measurement tools to simple databases for collating and sharing information and data.

- Increasing the openness to and use of innovative technology-driven solutions. The level of complexity needs to be adjusted to the specific local context. This includes using mobile technology for contract management, mobile money for premium payments and insurance pay-outs as well as blockchain technology for mobilising finance.

- Overcoming misaligned seasonal income patterns and revenue cycles of agribusinesses and repayment schedules for loans through restructuring of transactions and payment flows.

- Mobilisation of new stakeholders, and investors, such as private companies, commercial banks, and consumers from the wider public as new sources of adaptation financing and tapping into underutilised markets (e. g. online game community or urban youth).

- Usage of gamification as a cross-cutting solution strategy: The basic principle of gamification approaches is to use game elements, online games, or fun activities in non-game settings for value and impact creation in order to reach new target groups.

- Coupling of different service offerings by financial institutions or technology providers, such as combining the provision of financing with sharing information about business practices or supplying technology solutions.

Importance of Specific Country Contexts for Bottom-Up Adaptation Finance

The Lab process has reconfirmed that paying attention to the very context-specific and local demands, requirements, and capacities of countries is fundamentally important for identifying challenges and designing and implementing approaches and solutions for adaptation finance. An inclusive process that integrates local perspectives and knowledge about the specific context is likely to help pinpoint the challenges to be addressed in the most accurate way while also furthering the needed acceptance and to increase the efficiency and effectiveness of proposed solutions.

Despite the many similarities across the countries and prototypes, this work identified some fundamental differences throughout the Lab process that need to be considered when developing or replicating respective prototypes (abridged – see full text for more detail):

- The varied levels of economic development in the three countries are directly reflected in the way the respective banking sectors are structured. Financial institutions in Thailand and India are generally very well established but have limited interest and capacity to work in the specific field of adaptation finance. In contrast, the banking sector in Uganda is significantly weaker and lacks capacity and presence in a couple of sectors and certain geographical areas. The development of new financial instruments for adaptation need to take such differences into account in order to be effective.

- In line with this, paying attention to the very context-specific demands, requirements, and capacities is fundamentally important when implementing creative processes for developing innovative solutions to existing challenges in specific sectors and countries, such as the prototypes for adaptation finance challenges in this case.

- Challenges in a less developed sector can often be tackled most effectively by rather small but focused innovations and straightforward solutions (e.g. irrigation financing model via microleasing in Uganda) whereas overly complex instruments might not even work that well in the same context.

- On the other hand, in a highly technology-driven country like Thailand, there is great appetite for purely tech-driven innovations that integrate blockchain technology and cryptocurrencies, whereas potentially effective but simple solutions addressing a specific challenge might fail in creating excitement among the target group.

- Another key aspect to keep in mind is the policy and regulatory framework in the respective countries. Paying attention to the existing policies in a country is crucial for developing effective new approaches and solutions. Examples of relevant policies to pay attention to in the prototype design include existing subsidy schemes for specific sectors or banking regulations. It is important to make sure that these framework conditions are kept in mind as all developed solutions need to be applicable to the respective regulatory framework in the rollout stage in order to be effective.

Suggested Citation

Restle-Steinert, Jonas and Tobias Hausotter (2019): Bottom-Up Innovation for Adaptation Financing. New Approaches for Financing Adaptation Challenges Developed through the Practitioner Labs Climate Finance. Berlin: adelphi.